LIFE CARE PLANNING

What is Life Care Planning?

Life Care Planning is a relatively new specialty of Elder Law that helps people find and pay for quality care. It is a holistic, elder-centered approach to the practice of law that helps families respond to every challenge caused by chronic illness or disability of an elderly loved one. Elders and their families get access to a wider variety of options for care as well as knowledgeable guidance from a team of compassionate advisors including an Elder Law Attorney, Life Care Coordinator and other who help them make the right choices about every aspect of their loved one's well-being. This team is particularly knowledgeable in the areas of estate planning, Veteran's and Medi-Cal benefits and available resources in your community.

Our firm are uniquely qualified to assist clients in negotiating the complex system of estate and trust planning, asset preservation, qualification and application for Medi-Cal and other public benefits, as well as Veteran's benefits. We patient rights advocacy, review of assisted living and nursing home contracts, care management, care placement assistance, and hospital discharge planning assistance.

Life care planning may also involve the review of long term care insurance, annuities and reverse mortgages or referral to financial planners who may sell such products to clients who require these services.

What Does A Life Care Plan Include?

The Life Care Plan includes:

1. Specific quality recommendations to make sure that the elder gets appropriate care, whether at home, or through assisted living facilities or and nursing home facilities to maintain the quality of life that s/he desires. These recommendations will be made by your Life Care Coordinator.

2. Locating public and private resources which the elder can qualify for which will help pay for long-term care. Concrete legal strategies to qualify for benefits to pay for care and protect assets. We will guide you step by step through the entire process from applying for public benefits (VA/Medi-Cal/local government benefit programs) to appropriately spending down your assets in order to meet various income and asset criteria.

3. All legal documents necessary to ensure that the client wishes are met regarding healthcare, finances, and distribution of assets when the time comes. This might include wills, trusts, powers of attorney, advance directives and other documents.

Who benefits from Life Care Planning?

There is a wide range of families and individuals who require or desire life care planning services. Anyone who needs assistance or may require health care assistance in the future is a candidate for life care planning.

Folks who can benefit from life-care planning include

- Elderly individuals with special needs, including Alzheimer, Parkinson and other degenerative diseases

- Younger individuals with a disabling or debilitating disease or condition, including multiple sclerosis (MS), ALS, brain damage or other serious or debilitating injury or condition requiring long-term care

- Individuals requiring nursing home care or assisted living, including in-home care.

Life Care Continuum

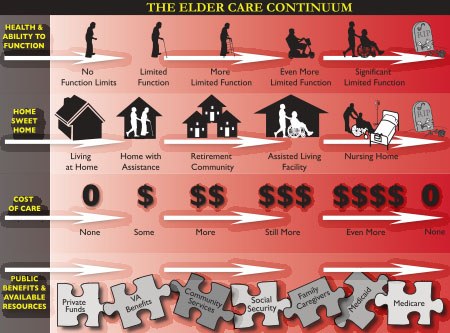

We uses a model called the Elder Care Continuum to help families understand the natural progression of aging and its impact on a loved one's health, mobility, housing, and financial resources. Link to Elder Care Continuum.

This continuum helps families view the care journey as process that begins long before family members are forced to scramble to find ways to pay for long-term care. It helps the family focus on where the elderly loved one's place on each line of the Continuum. Once you know where you are in the process, we will help you identify gaps in care, and suggest options for how to mobilize resources and public benefits to close those gaps. The goal is to plan for the best care for your loved one, both now and in the future.

What happens during the Life Care Planning process?

When you meet us for the first time, the focus will be on locating your loved one's position on each domain line of the Elder Care Continuum, which is a model that helps families understand the natural progression of aging and its impact on a loved one’s health, mobility, housing, and financial resources. Once you know where you are in the process, we will help you identify gaps in care, and suggest options for how to mobilize resources and public benefits to close those gaps. The goal is to plan for the best care for your loved one, both now and in the future. When your loved one's Life Care Plan is developed, it will define, organize, prioritize and mobilize every aspect of his or her care.

Care Coordination

Many families who need help protecting an elderly loved one's assets also need help finding and coordinating care. They need help with decision-making as the elder's condition progresses. That's why we work with a Care Coordinator who oversees the coordination of your loved one's health and long-term care, serves as your advocate and empowers you with the knowledge you need to make the right decisions for your loved one in every circumstance. Whether your loved one is living at home, at an assisted living facility or in a nursing home, you can relax in the knowledge that his or her care is being coordinated by experts who have extensive knowledge about the costs, quality, and availability of resources in the community.

What Does a Care Coordinator Do?

Your Life Care Coordinator assists with the development and implementation of your Life Care Plan including:

- An initial assessment in your home, residential or health care facility

- The development, implementation and monitoring of a Care Plan

- Assistance with living arrangements and placement

- Coordination of available community resources

- Coordination with family to provide support, guidance and advocacy

Conclusion:

Elders have a legal right to safe, effective and patient-centered health care and long-term care. The components of a Life Care Plan add up to A Life Care Plan protects those rights. It provides peace of mind for elders and the families who love them. We work on your behalf to resolve care issues, manage transitions to more appropriate care and stand up for you when you need it. We work in tandem with our elder care coordinator to provide advocacy services that empower family caregivers and protect quality of life for elders. Whether you live across the street or across the country, a Life Care Plan offers welcome reassurance that your loved one will enjoy the best possible quality of life until the end of life.